Chatham Borough recently took a fresh look at the market value of taxable real estate in town as of October 1, 2022.

We’ve all seen the results: significant increases in the assessed values the Borough will use to calculate our property taxes.

Will those higher assessed values mean higher property taxes?

Not necessarily. The Borough revaluation shouldn’t increase your property tax bill unless the value of you property has risen faster than the total value of taxable real estate in Chatham Borough – the tax base.

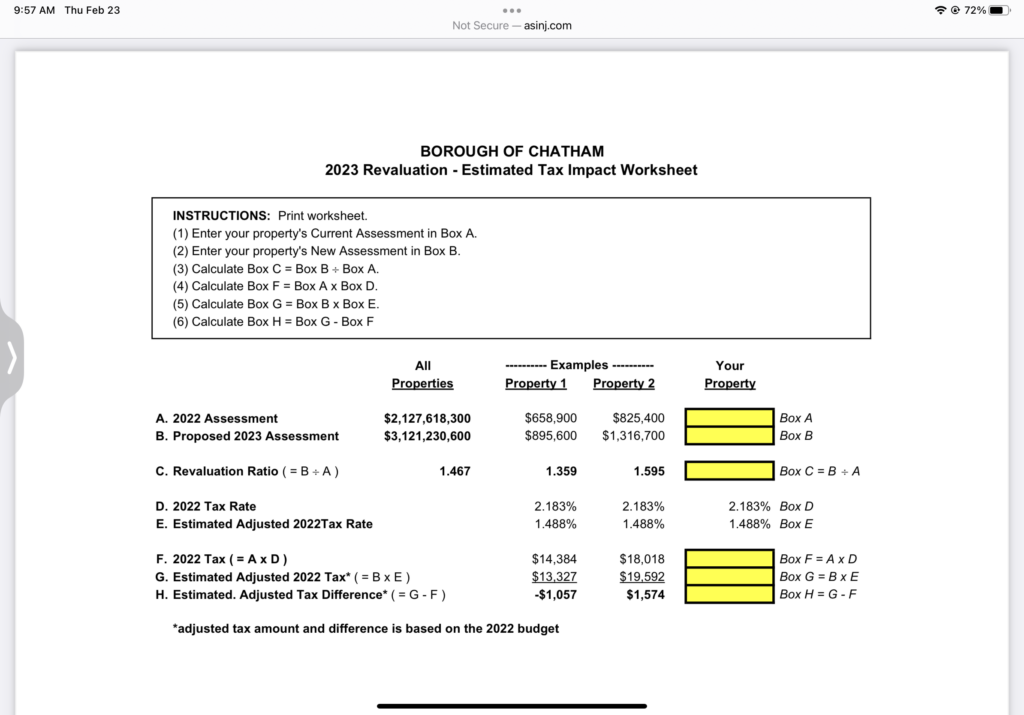

You can estimate the actual effect of the reassessment on your property using this handy online calculator provided by the firm doing the reassessment: http://asinj.com/revaluation/docs/taximpact/443/Chatham%202023%20Revaluation%20Tax%20Worksheet.pdf

The calculator is easy to use:

Just fill in Boxes A and B with the values shown in your reassessment letter and last tax bill. The calculator will do the rest, comparing the change in the value of your property with the change in the value of all taxable property in the Borough, and using the estimated new tax rate in Box E – 1.488% – to predict how much your property tax bill will go up or down. The answer will appear in Box H.

Beware: The result you see in Box H paints a rosy and misleading picture.

Your actual tax bill will probably increase a good bit more than the calculator indicates in Box H, because the estimated 1.488% property tax rate shown in Box E is almost certainly too low.

The new tax rate estimate shown in Box E is probably too low, because it does not take into account likely looming increases in this year’s local budgets.

How do we know the new estimated tax rate doesn’t take into account those looming local budget increases? The proof is in last line, below the calculator, where it says the estimated 1.488% tax rate in Box E assumes our Borough and School District budgets will stay at 2022 levels.

Fat chance. Both the Borough Council and the School Board are fixing to increase their spending in ways that will probably mean significantly higher property tax bills all around.

While it’s certainly possible that the Council and School Board really do need more money to fulfill their respective missions, we shouldn’t blindly accept annual tax increases. They should go through normal channels and ask taxpayers for what they need

The Borough Council could even REDUCE our property taxes simply by: 1) increasing the tax base (for instance selling excess tax exempt Borough real estate); 2) using the proceeds for urgent needs like a new fire truck; 3) using new sources of revenue (like the PILOT payments) for other absolute necessities (like affordable housing at Post Office Plaza); 4) putting off spending on inessentials; and 5) flatly refusing to make outright gifts using taxpayer funds.

Instead, some Council members seem bent on doing just the opposite, which will make your property taxes continue to increase.

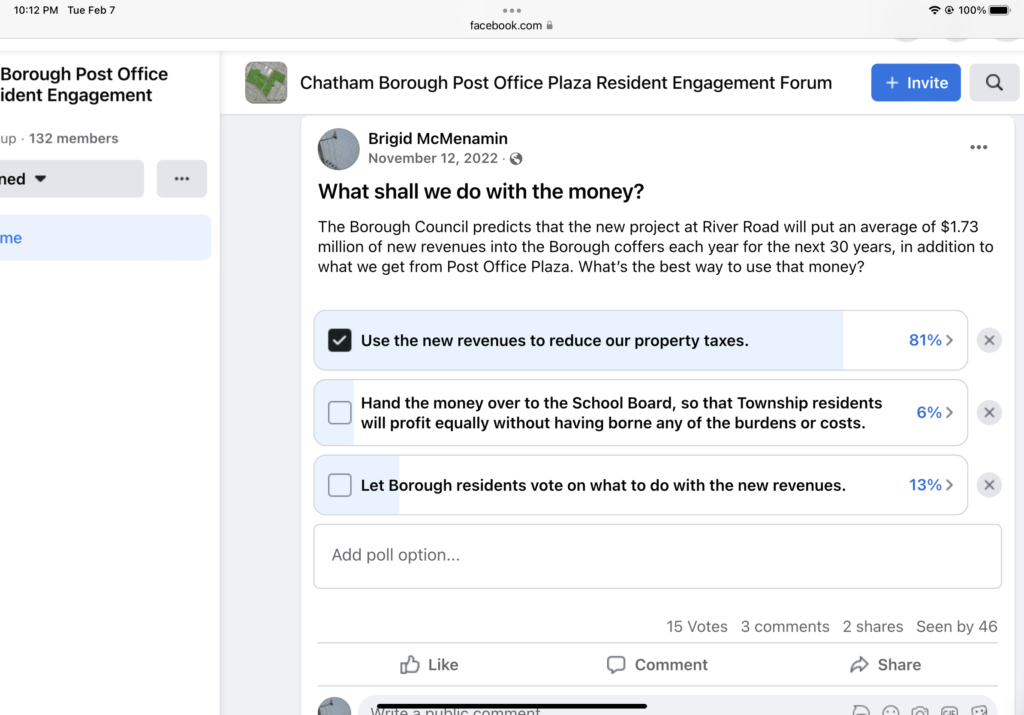

For instance, some members of our Council aim to gift a portion of the Borough’s PILOT revenues to the School District.

With so many pressing demands on our Borough funds, you really have to wonder why any Council member would even consider giving away Borough money – especially to an entity like the School District, which already has far greater resources than does the Borough.

The reasons offered for that gift are based on myths:

MYTH: The PILOT payments are “found money” – extra funds for the Council to spend as it pleases.

FACT: The PILOT payments are Borough assets, property of the taxpayers.

We earned that PILOT money by granting the developer a property tax exemption for 30 years. Though the Council is free to spend -or squander – that money on pet projects and discretionary gifts, that isn’t the right thing to do.

The right thing for the Council to do is to use the PILOT money with the same care and discretion they would if the developer were required to pay full property taxes.

If that PILOT money were from normal property taxes, the Council couldn’t spend it on a whim. By law, the Council would get only 102% of what it got last year – plus enough to cover certain exceptional expenses. The Council would be required to use the balance of the funds to lighten our property tax burden.

That is exactly how the Council should use the PILOT money – unless we residents and taxpayers agree otherwise.

MYTH: Right or no right, the School District DESERVES a portion of the River Road PILOT payments, because it would have been entitled to a portion if the Council were collecting real property taxes on the project.

FACT: Even if the River Road developer were paying full property taxes, the School District would NOT be entitled to a portion of the additional property taxes collected.

Why? The School District’s share of our property taxes is NOT based on the amount collected. No matter how much – or little – the Borough collects in property taxes, the School District gets the same amount: 102% of what it got last year, plus enough to cover certain extra expenses. The Borough Council has NO OBLIGATION to give the District any extra property tax funds.

MYTH: Even if the School District isn’t automatically entitled to a portion of the PILOT payments from River Road, it should get a portion, to make up for the additional cost of educating school children who will move into the River Road development.

FACT: The prospect of additional school children does NOT entitle the School District to any additional funding from property taxes

Higher district-wide enrollment might get the School District of the Chathams a little more state aid, but that’s a drop in the bucket, making up only about 5% of our School District’s nearly $85.6 million budget for the current 2022-2023 school year.

Whether school enrollment skyrockets or plummets, the Chatham School District is entitled to the same 102% of what it got from property taxes last year, along with enough money to cover certain exempt expenses.

And in the Chathams, enrollment isn’t increasing. It’s falling. It has been falling for years, and the Superintendent has predicted it will continue to fall until at least 2029.

When even an increase in overall, district-wide enrollment wouldn’t entitle the School District to any additional school property taxes, a few more children in the River Road developmentcannot justify arbitrarily gifting a share of the Borough’s own PILOT revenues.

MYTH: If the Borough doesn’t choose to share its PILOT payments with the School District, our schools will suffer.

FACT: The School District of the Chathams is pretty well insulated from financial pressure. Its budget tops $85 million – more than twice that of the Borough and Township combined – and the District enjoys an absolute right to local property tax funding in the amount of 102% of what it got from Borough and Township property taxes the year before, plus enough to pay certain other expenses, totaling approximately 90% of its annual budget, and our School District also routinely qualifies for state and federal aid.

Is it possible that our School District nonetheless really needs even more local funding than it’s already guaranteed by NJ law. Yes, sure.

If the School Board does in fact need more money to run the schools, it can and should get the necessary funds directly from the taxpayers, in a referendum or second question, same as Westfield’s school board is doing: https://www.tapinto.net/towns/westfield/sections/education/articles/westfield-schools-early-budget-figures-above-nj-s-cap-voters-will-choose

For the Borough to simply give away much-needed Borough PILOT money to the School District would be like giving away New Jersey tax dollars to the U.S. Department of Defense – a far bigger entity with its own funding source.

MYTH: Giving PILOT money to the Schoool District would force the developer to pay its fair share of school costs.

FACT: Gifting PILOT money to the District would have NO effect on the developer.

All that gift would do is deprive Borough taxpayers of our chance to use the funds for urgent necessities like a new fire truck – or perhaps a tax break.

There is no justification for the Council to simply gift our PILOT funds to the School District, and darn good reasons not to make such gifts: Not only would it be financially irresponsible, it would also be tantamount to an end run around School District parents and residents. Such gifts would raise the specter of partisan meddling in our schools.

Even a small gift to the School District would establish a dangerous precedent, and the dollar amount could be adjusted upward each year, as former Borough engineer Vince Denave noted at a 2021 Town Hall.

If the Council is considering take such risks, it should explain why – and get the informed consent of residents BEFORE making any decisions.