Hearing conflicting claims about affordable housing? Like to separate the facts from spin & fiction?

Free ice cream at Scoops, a slice at Bucky’s, or coffee at Fleur de Sel for the first person who can find a factual error in the following post.

MYTH: Chatham Borough has a history of shirking its affordable housing obligations!

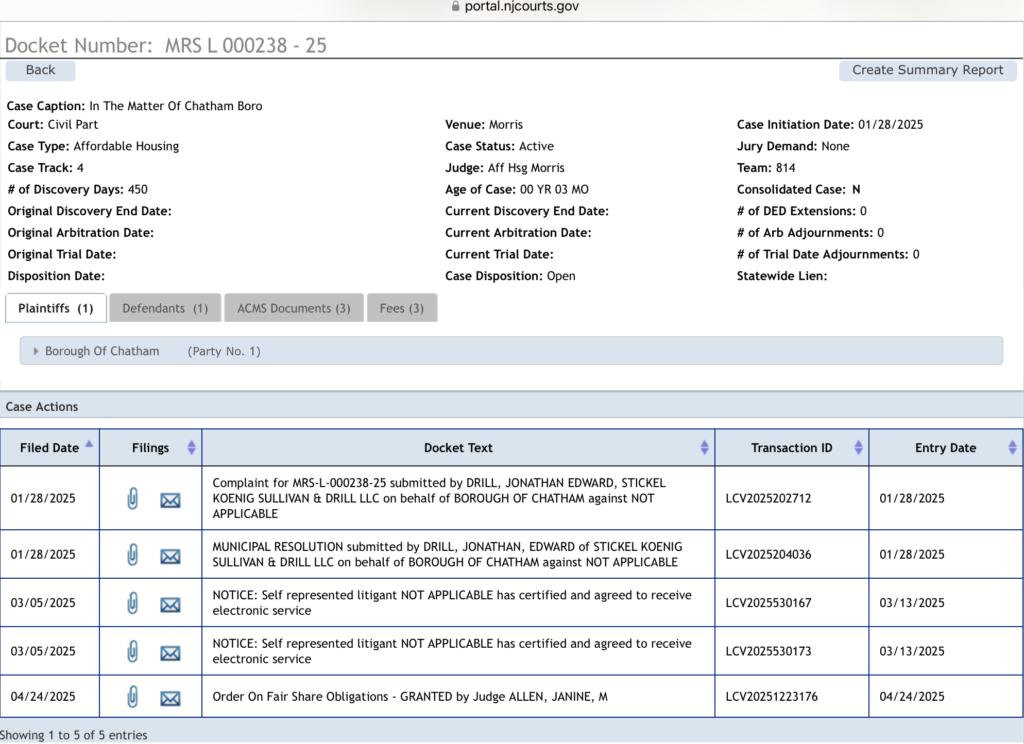

REALITY: Not so. The Borough has met its affordable housing quotas so far.

MYTH: Before June 30, Chatham must agree to build affordable housing on the green, woodsy, vacant, Borough-owned lot at 58 N. Passaic, right next to Memorial Park, or else the Borough will risk lawsuits that would destroy the town!

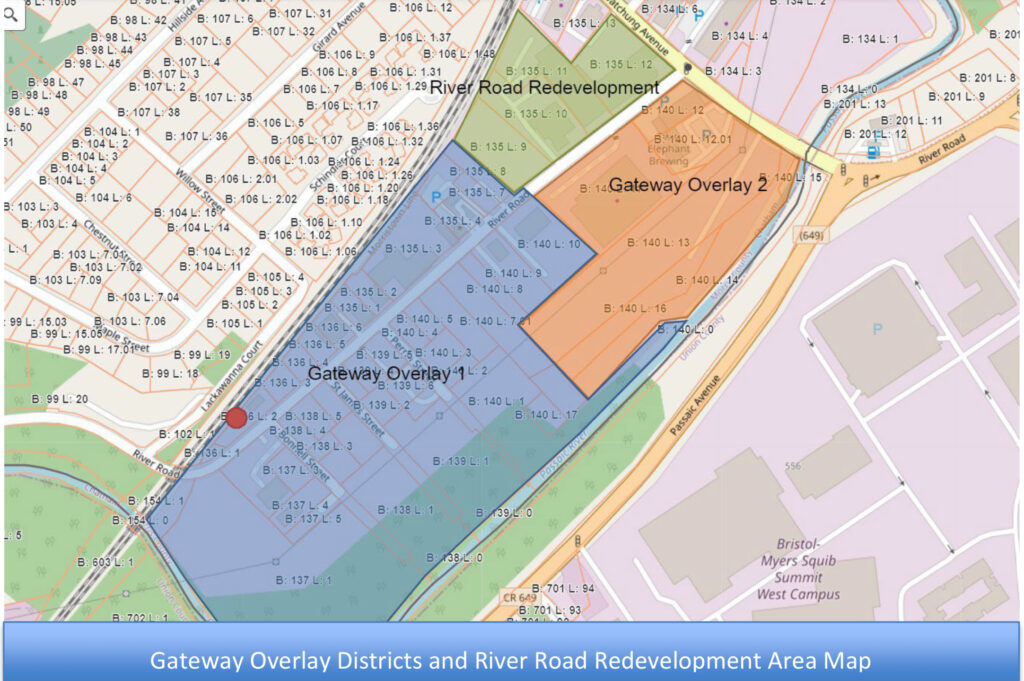

REALITY: Not so. Like virtually all other NJ municipalities, Chatham Borough has until the end of June to revise the Housing Element of its Master Plan to meet a new quota, but the Borough is NOT required to build anything on that particular green, woodsy, vacant, Borough-owned lot right next to Memorial Park, and the Borough cannot be held liable for declining to let a developer build there.

MYTH: The Planning Board must have had a good reason for choosing to develop that green, woodsy, vacant, Borough-owned lot right next to Memorial Park!

REALITY: No, the Planning Board did NOT select that lot for development. Only a few political bosses even heard about it before May 7, when a non-resident expert told the Planning Board about a proposal to change Borough policy by changing the Housing Element of the Master Plan, an amendment they won’t see until at least June 6, but will be steamrolled into adopting on June 18. Start approx. 46:00 here: https://chathamborough.granicus.com/MediaPlayer.php?view_id=1&clip_id=368

MYTH: The Borough Council must have had a good reason for choosing to develop that green, vacant, Borough-owned lot right next to Memorial Park!

REALITY: The Council did NOT vote to select that lot for development. Half the Council never heard about it until a few days before the Planning Board first heard about it on May 7. The Council never even mentioned it in public until the May 12 Council meeting, when residents started asking questions. The Mayor said they couldn’t talk about it, but the reason, if any, was not clear. If the Council can’t discuss a change in Borough policy, who can?

MYTH: There must be some explanation. Nobody would sacrifice a green, wooded, vacant, Borough-owned lot right next to Memorial Park without having determined that it was the best – or only feasible – option.

REALITY: So far nobody’s shown any evidence that anybody considered any alternatives before targeting that green, woodsy, vacant, Borough-owned lot right next to Memorial Park. The expert who presented the idea to the Planning Board said essentially, we owned that lot, and the developer wanted it, so we made a deal. Start approx. 1:09:00 here: https://chathamborough.granicus.com/MediaPlayer.php?view_id=1&clip_id=368

MYTH: The Environmental & Shade Tree Commissions must have approved targeting for development this green, woodsy, vacant, Borough-owned location right next to Memorial Park!

REALITY: No, neither Commission was even consulted. The Environmental Commission members who aren’t also political bosses didn’t hear about it until residents broke the news to them at the May 14 meeting. The only person on the Shade Tree Commission who knew about it was Council member Karen Korenkiewicz, who kept mum about it until a resident shocked the Shade Tree Commission with the news at its May 22 meeting.

MYTH: This wasn’t a secret, back-room deal, so there must be some record as to who chose that green, woodsy, vacant, Borough-owned lot and why!

REALITY: On May 7th the expert told the Planning Board the proposal was the work of a certain “advisory committee.” But the committee she credited with developing the proposal has NO public meetings, NO agendas, NO minutes, and takes NO public input. It isn’t even on the list of advisory committees on the Borough website as of yesterday.

MYTH: They’re going to do what they’re going to do. You can’t make any difference!

REALITY: Yes you can make a difference. You did it with the rolling reassessment, the peddler curfew, Post Office plaza, and the Middle School Arts Center. You can do it again. Our local leaders tend to consider their actions far more carefully when faced with strong public interest in an issue.

So whatever your views:

- Talk to friends on the Council, Planning & Zoning Boards, and the Environmental & Shade Tree Commissions.

- Write mayorcouncil@chathamborough.org and shadetree@chathamborough.org.

- Attend or Zoom the Council meeting on Tuesday, 5/27/25 and Planning Board meeting on 6/4/25, both at 7:30 pm, Borough Hall, 54 Fairmount Avenue, upper level.

- Encourage everyone you know to do the same.