Delighted to see some fresh faces at the May 8 Borough Council meeting. Kudos to the four newcomers who stepped up to the microphone that night to talk about the biggest issue facing the Borough, namely:

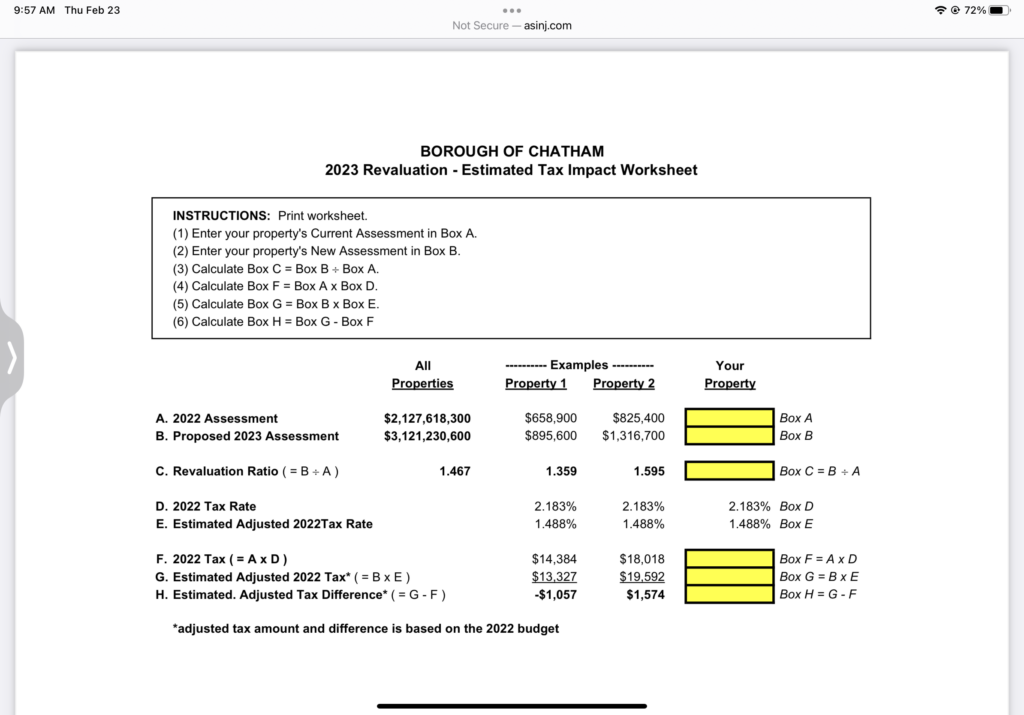

Shall we use our Borough PILOT revenue from the new River Road development to reduce our property taxes and pay for urgent necessities like fire trucks? Or shall we spend that money on luxuries and gifts?

Before that night, every Borough resident who spoke out asked the Council to use our PILOT money for property tax relief and urgent necessities like fire trucks.

We heard a different point of view at that May 8th Council meeting, where three Borough residents – and a lady from Chatham Township – asked the Borough Council to spend some of our Borough PILOT money on gifts to our joint School District.

(Click here https://chathamborough.granicus.com/MediaPlayer.php?view_id=1&clip_id=129 and start around minute 1:07:00)

That’s understandable: Education is a worthy cause. If the schools need more money, then they should have it. And vigorous discussion can help foster informed decision-making.

Yet judging from the comments made at that Council meeting, we are nowhere near ready to make an informed decision about our Borough PILOT money. Some of the speakers seemed downright confused.

For instance, most of the speakers didn’t seem to realize that the PILOT money is OUR money – a Borough asset. If we give it away, we’ll have to raise our Borough property taxes to pay for necessities like fire trucks.

Also, most of the May 8 presentations to the Council rested on the mistaken assumption that the School District is is short on funds and has nowhere else to turn for help.

That simply isn’t the case.

In fact, the School District has far greater resources than does Chatham Borough – including a $86.3 million annual budget and the option to raise additional funds from Borough and Township taxpayers alike, using ballot questions like the two we’ll vote on this November.

https://chathamchoice.org/2023/04/what-does-it-take-to-educate-4000-children-teens/?preview=true

As such, simply gifting scarce Borough funds to the School District makes no more sense than giving them to the local Post Office, New Jersey Transit, the Morristown hospital.

Important as those institutions are, they aren’t municipal functions, and neither is the School District. The Council has no business diverting scarce Borough resources to any non-municipal purpose without voter approval.

What’s more, the Borough Council has no right to meddle in School District affairs. It should stay in its own lane, and defer to the proper authority on local education: the School Board.

If the School District needs more money, the Township and Borough should share the expense – the same way they share every other cost of operating the schools- following the normal process the School Board has been using for years:

Residents pitch their ideas to the School Board. If the Board deems an expenditure worthwhile, it either fits it into its regular guaranteed annual budget, or else floats a ballot question, giving Borough and Township residents alike the chance to decide if the idea justifies raising our taxes. That’s the normal procedure. The Borough Council plays no role in that..

If the Council is determined to overstep its traditional role and consider diverting our Borough PILOT funds for a gift in excess of the Borough’s fair share of school expenses, it certainly should not do so without the consent of residents.

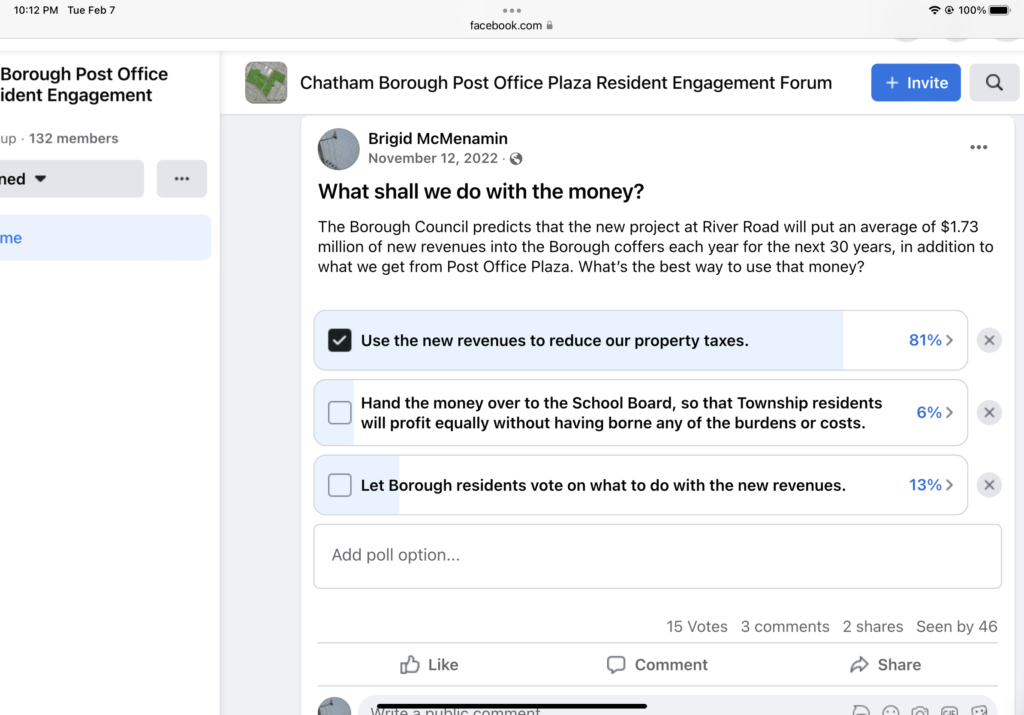

The Council should put the question on the ballot and let Borough voters decide.

At the very least, the Council should provide a timely forum for vigorous, robust public debate before even considering earmarking our Borough PILOT money for any particular purpose.

The Borough Council and voters alike should beware of making such an important choice based on false assumptions. For instance:

PILOT PAYMENTS: MYTH versus REALITY

MYTH: Only a selfish cheapskate – who values money more than the education of our children – would oppose gifting our Borough PILOT money to the School District.

MYTH: The School District deserves a portion of our Borough’s River Road PILOT money, because the District would have received nearly two thirds of the property taxes from River Road if it paid property taxes.

REALITY: Not so. It’s a question of accountability. For the Council to gift money to the School District is to do an end run around voters, diminishing the community’s voice in our schools – and potentially subjecting them to partisan political control.

REALITY: Not so. Given the 2% cap, the School District wouldn’t be entitled to any additional property tax revenue if River Road were a taxpaying development.

MYTH: Even if the School District isn’t legally entitled to a portion of the PILOT money, the Council should gift the District PILOT money in light of the additional schoolchildren at River Road.

REALITY: Nonsense. Absent voter approval, the School District’s portion of property taxes remains exactly the same whether enrollment plummets or soars. Why should the possibility of additional school children at River Road change that rule?

MYTH: If the Borough doesn’t promise to share our PILOT money with the School District, the quality of education will suffer.

REALITY: Nonsense. The School Board president has admitted it’s impossible to predict how much – or even if – the River Road project might increase school expenses. If it does increase expenses significantly, the District will budget for it – or else float a ballot question to raise more money, just like every other district in the state.

MYTH: If the Borough Council doesn’t share our PILOT money with the School District, it will unfairly burden Township residents with the cost of educating additional Borough school children at River Road.

REALITY: Preposterous. Borough residents are required to help bear the cost of educating additional children from new Township developments like the Enclave. How is it unfair for Township residents to help bear the cost of educating additional children from a new Borough development like River Road?

Tell your Mayor & Borough Council what you think!

[email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]

For the response click here: https://chathamborough.granicus.com/MediaPlayer.php?view_id=1&clip_id=130 (Minute 2:14:45)

For more detail, check out this letter:

Care to dig deeper? Click here: